Empowering Sales & Marketing Teams

Evolve with CRM solutions that propel you forward

Delivering state-of-the-art CRM solutions encompassing integrations, migrations, customized training programs, and custom development to enhance your business's agility, efficiency, and customer engagement capabilities.

Custom Integrations | CRM Extensions ISO 27001 Certified

10,000

+

App

Installs

100

+

Sales & Marketing

Certifications

4.9/5

*

Customer

Satisfaction

Services

B2B CRM Integration, Implementation & Training

Elevate productivity and revenue with our strategic CRM solutions. We specialize in crafting bespoke solutions that enhance your team's efficiency and your company's bottom line. Our approach focuses on delivering a holistic CRM experience, encompassing everything from seamless system integration to effective onboarding. Trust us to transform your business processes with our expertise and innovative strategies.

What Our Clients Have to Say

“[T]heir team took the experience to another level”

“[SyncMatters] is a great product but their team took the experience to another level and made the whole project much less stressful. They allowed us to actually find a solution that served our customer really well and allowed us to execute a successful migration.“

Ashlee Rolkowski

- Marketing Manager at Lone Fir Creative

“The relationship with [SyncMatters] has exceeded every expectation”

“Zaynab Babacan has been training our staff for almost a year now and she is brilliant, patient and kind. Always extremely professional, Zaynab finds a way to make complicated things seem simple. She has become an extension of our marketing department and one of our most valuable resources!“

Madeline Vaz

- Associate Dir. of Marketing at The Motherhood Center

“I would recommend them without hesitation”

“As with most data migrations from one CRM to another, we considered doing it ourselves until we calculated the lost opportunity cost. We had quite a complex and custom migration. The accuracy in the data migration is spot on.“

Tom Ziegelbauer

- CTO at 0 Percent

“We used [SyncMatters] to migrate 13+ HubSpot CRM instances into a single Salesforce instance”

“The process was super easy and ultimately saved us a bunch of time. I recommend them if you require migrating data.“

Steve Namuth

- Director of Business Analytics & Systems at Blackboard

Products

CRM Migration

Robust CRM data migration platform

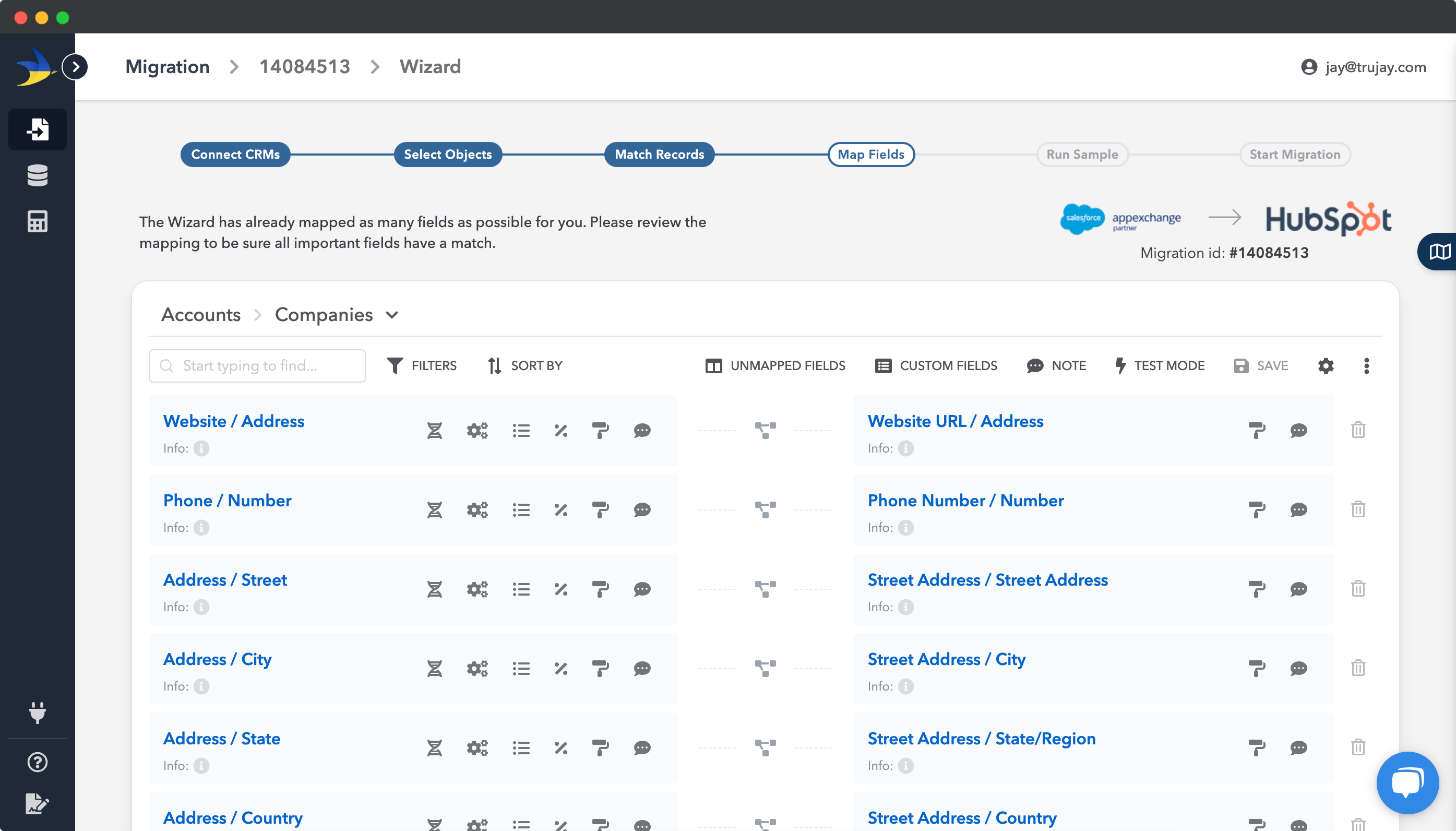

Our robust CRM data migration and data management platform is designed to seamlessly handle the challenges of both simple and complex use cases.

With our solution, you can effortlessly transfer your CRM data and streamline the migration process, eliminating any pain points along the way. Trust us to take care of your CRM data migration needs, so you can focus on what matters most – growing your business.

CRM Data Migration Platform

FindMyCRM

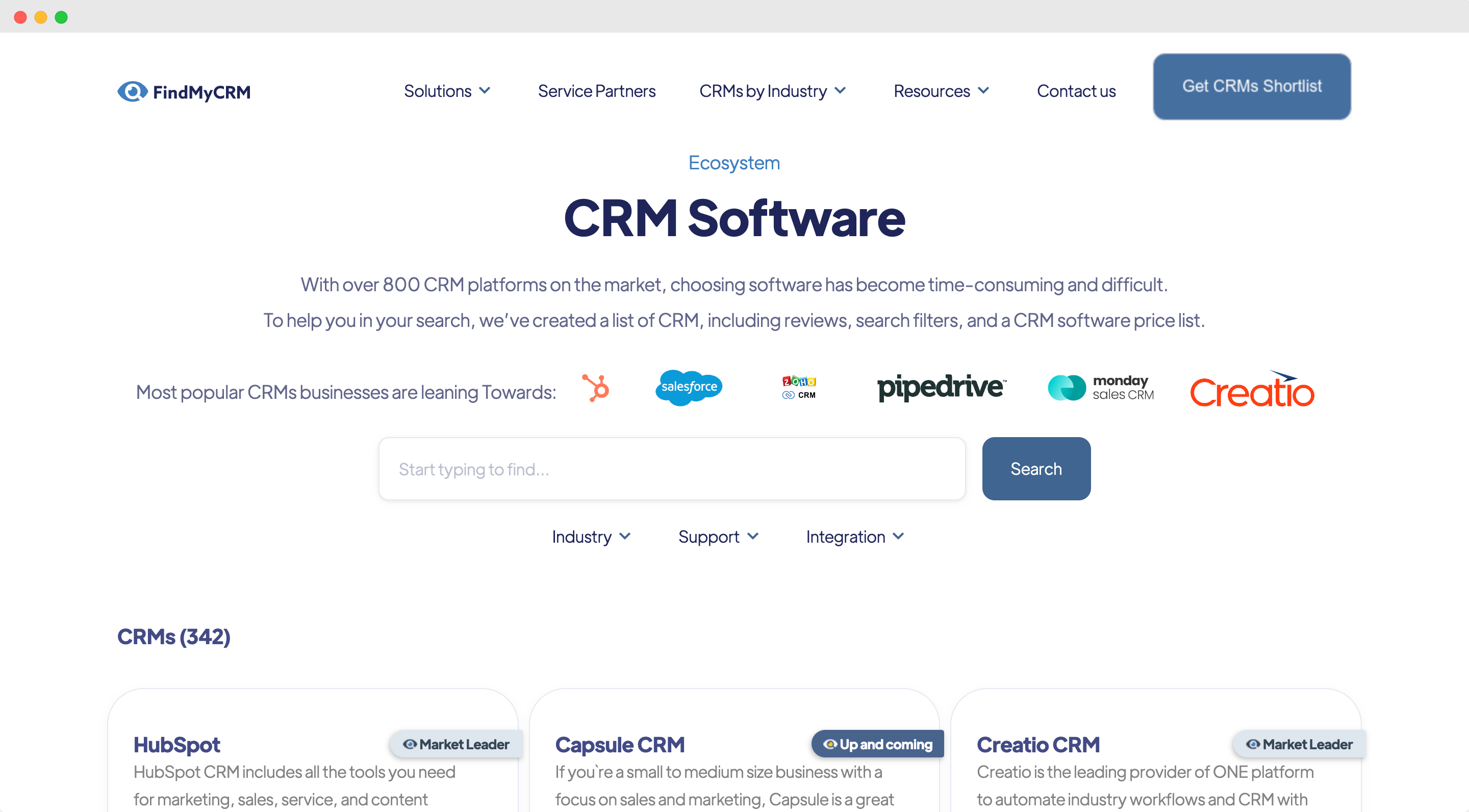

CRM software and services review platform

Looking for the perfect CRM software to streamline your business operations? Look no further. With our comprehensive reviews and insights, finding the right CRM solution for your business has never been easier.

Say goodbye to the time-consuming legwork. Trust us to simplify the process and help you make informed decisions for your business's success.

CRM Finder

Why do you need SyncMatters?

- • Boosted Productivity and Revenue: Unlock the full potential of your tools and witness tangible growth.

- • Proven Expertise: With elite industry partnerships and extensive experience, you're always in trusted hands.

- • Tailored for You: Whether you're new to your CRM or seeking to optimize it, our services adapt to your unique business needs.

- • Maximum Impact, Minimal Disruption: We design solutions to drive substantial results without hindering your daily operations.

CRM Partners

SyncMatters is at the forefront of CRM integration and solutions, offering expert guidance and strategic implementation across a range of leading platforms. We proudly partner with industry leaders such as monday.com, HubSpot, and Salesforce, bringing a wealth of experience and tailored solutions to each platform.

%20(2000%20x%20300%20px)%20(1).png)

Our close alignment with HubSpot, as a certified Elite HubSpot partner, enables us to offer exceptional expertise in HubSpot solutions. Accredited in Onboarding, Integration, and Data Migration, our team of specialists delivers strategic and efficient solutions tailored to enhance your business processes and data management. This partnership represents our commitment to unlocking your business's potential through meticulous preparation and customized strategy.

%20(2000%20x%20300%20px).png?width=440&height=68&name=Untitled%20(500%20x%20150%20px)%20(2000%20x%20300%20px).png)

No matter the CRM platform, SyncMatters is dedicated to transforming your business operations with streamlined, effective solutions tailored to your unique needs.